In August 2024, the U.S. multifamily market witnessed a continued slowdown in rent growth, with several underlying factors contributing to this trend. RealPage’s latest data analysis reveals a dynamic landscape where shifts in demand, supply imbalances, and economic uncertainty play pivotal roles.

Key Trends in Rent Growth

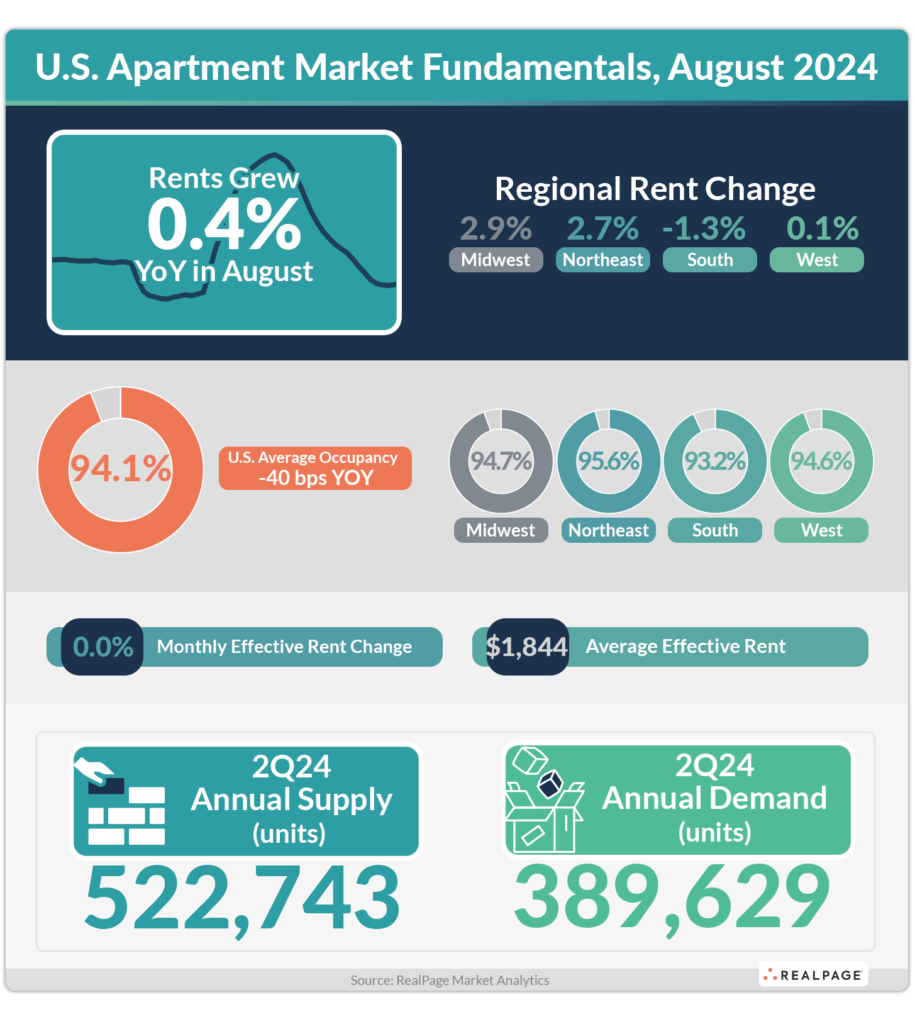

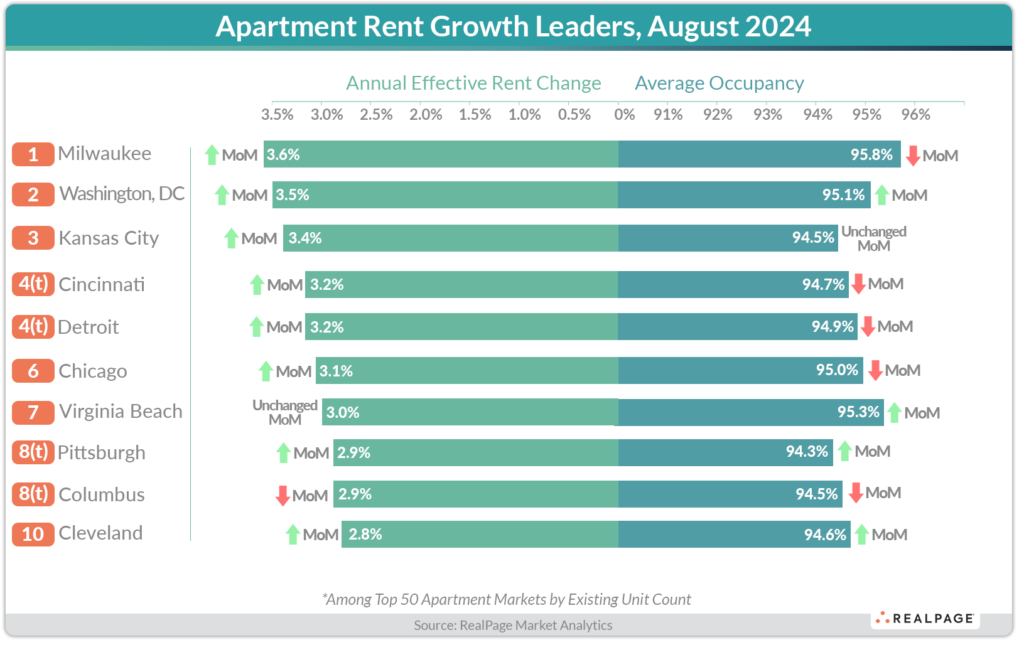

Rent growth has decelerated significantly compared to previous years, a trend that has been observed throughout 2024. While there is still some positive rent growth in select markets, the national average shows a marked cooling off. This slowdown is primarily driven by a combination of softer demand, increased supply, and economic pressures affecting renter behavior.

Demand Shifts and Regional Differences

Demand for multifamily housing has softened across various regions, particularly in markets that saw substantial rent increases in previous years. Sunbelt markets, which were previously leading the rent growth race, are now experiencing a more pronounced deceleration. In contrast, some Midwest and Northeast markets have maintained relatively stable growth, benefiting from their more moderate rental rates and less intense supply pressures.

Impact of New Supply

The surge in new supply has also played a critical role in balancing the rental market. A significant number of new multifamily units have entered the market, leading to increased competition among property owners and operators. This influx of new inventory, particularly in urban cores, has contributed to more competitive pricing and a slowdown in rent increases. Many landlords are now offering concessions and other incentives to attract renters.

Economic Factors Influencing Renter Behavior

Economic uncertainty, including concerns about inflation and job stability, continues to impact renter decision-making. Potential renters are more cautious, leading to extended decision cycles and increased price sensitivity. This cautious approach is evident in reduced leasing activity and a higher propensity for lease renewals rather than moving to new properties.

Future Outlook

Looking ahead, the multifamily market is expected to remain in a state of flux as it adjusts to these ongoing shifts. The balance between new supply and demand will be crucial in determining the trajectory of rent growth. Property managers and investors need to stay attuned to local market dynamics and renter preferences to navigate this evolving landscape successfully.

The August 2024 data update from RealPage highlights a multifamily market in transition. With rent growth slowing, supply expanding, and economic factors weighing on renter behavior, the market’s future will depend on how these dynamics continue to unfold. Stakeholders should focus on strategic pricing, enhanced renter experience, and localized market strategies to thrive in the current environment.